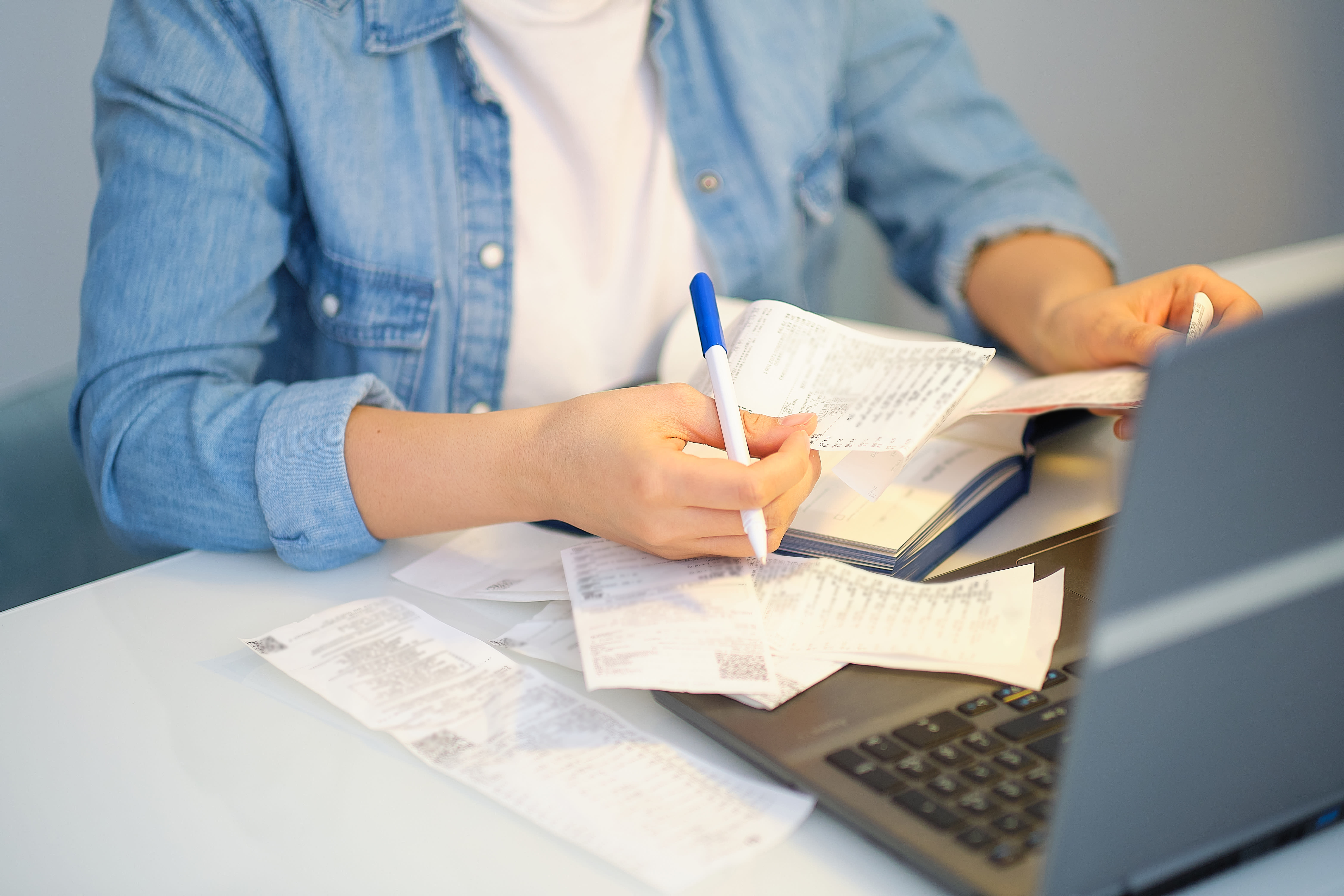

Expense fraud remains a significant challenge for businesses in 2024, leading to substantial financial losses and compliance issues. Despite efforts to combat it, our recent research shows that many employees still find it acceptable to submit fraudulent claims. This blog post delves into the key challenges business leaders face in preventing expense fraud and explores effective strategies, including the use of advanced technology like artificial intelligence (AI), to tackle this issue.

1. Understanding Expense Fraud in 2024:

Expense fraud includes both malicious intent and unintentional errors due to lack of knowledge. Business leaders must address both aspects to effectively prevent fraudulent activities. Let’s explore the primary challenges faced in this context:

2. Key Challenges Faced by Business Leaders:

a. Outdated Finance Processes:

Many businesses still rely on manual checks to prevent expense fraud, with 24% admitting their expense processes are not digitized. The labor-intensive manual audit process is prone to errors and inefficiencies. Integrating AI and machine learning, such as our Intelligent Audit solution, can streamline these processes, enhancing accuracy and efficiency.

b. Lack of Interest towards Policy:

A significant number of employees (48%) believe it’s acceptable to over-expense or disregard company expense policies at least once a year. This attitude often stems from feelings of being undervalued or unfairly treated. Robust policies and effective communication are crucial to changing this mindset and ensuring compliance.

c. Ineffective Expense Fraud Prevention Measures:

Only 21% of finance and travel leaders have implemented fraud awareness and prevention training. Without proper resources and prioritization, employee expense fraud is more likely to occur. Businesses must prioritize fraud prevention measures to mitigate this risk.

3. Solutions for Tackling Expense Fraud:

a. Creating a Robust Policy and Reinforcing Guidelines:

– Develop a clear, comprehensive policy that enforces accountability and highlights consequences for non-compliance.

– Educate managers on the importance of the policy and ensure they have a proper audit process in place when approving expenses.

– Regularly share an informative guide companywide to remind employees of what they should and shouldn’t be claiming, and how to submit claims correctly.

By enforcing these policies, businesses can instill positive habits in employees, leading to long-term compliance and reduced fraud.

b. Utilizing Technology:

– Leverage AI and machine learning to enhance the expense management process.

– Manage the introduction of new technologies with transparency, ensuring employees understand the benefits and addressing any concerns to foster open-mindedness and acceptance.

Embracing technology not only streamlines the audit process but also provides real-time insights into expense patterns, helping businesses proactively prevent fraud.

4. Conclusion:

In 2024, tackling and preventing expense fraud requires a multifaceted approach that combines robust policies, effective communication, and advanced technology. By addressing the key challenges and implementing these solutions, businesses can safeguard their finances, ensure compliance, and foster a culture of integrity and accountability. As we continue to navigate the complexities of modern business, leveraging AI and other technological advancements will be crucial in staying ahead of expense fraud.